“It is the private trading of complex instruments that lurk in the financial shadows that worries regulators and Wall Street and that [has] created stresses in the broader economy. Economic downturns and panics have occurred before, of course. Few, however, have posed such a serious threat to the entire financial system that regulators have responded as if they were confronting a potential epidemic.”

“It is the private trading of complex instruments that lurk in the financial shadows that worries regulators and Wall Street and that [has] created stresses in the broader economy. Economic downturns and panics have occurred before, of course. Few, however, have posed such a serious threat to the entire financial system that regulators have responded as if they were confronting a potential epidemic.”

—New York Times, What Created This Monster? by Nelson D. Schwartz and Julie Creswell, March 23, 2008

What began as a collapse in subprime mortgage-based securities (the result of higher interest rates…leading to programmed, but unplanned-for increases in adjustable-rate mortgage payments…leading to increased loan defaults…leading to plummeting investor confidence…leading to…) has now become a full-fledged credit contraction.

The negatives of this contraction affect both the meek and the mighty.

–Homes are lost. In my county, most mortgage defaulters are first-time buyers who were sold on affordable, zero-percent-down, adjustable, low teaser-rate mortgages. The little guy couldn’t resist.

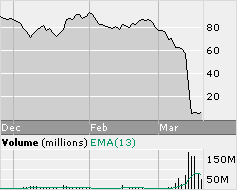

–A mega-wealthy investment bank is reduced to rubble. One month ago, Bear Stearns common stock was nearly $90 per share; it closed on March 20 at just under $6, after falling below $3 three days earlier. The big guys got mega-greedy.

It is clear that the unregulated proliferation of complex investment instruments, so-called derivatives, led to this debacle…and more bad economic news is coming.

Yet still financial conservatives decry any increased regulation of the free markets; they point to laissez faire economic policies that have enabled America to achieve worldwide economic superiority. (A warning: Great Britain—now trotting somewhere in the undistinguished middle of the herd—was, just 100 years ago, the world’s greatest economy, with the majority of important international dealings transacted in pounds sterling.)

Yet still financial conservatives decry any increased regulation of the free markets; they point to laissez faire economic policies that have enabled America to achieve worldwide economic superiority. (A warning: Great Britain—now trotting somewhere in the undistinguished middle of the herd—was, just 100 years ago, the world’s greatest economy, with the majority of important international dealings transacted in pounds sterling.)

Representative Scott Garrett (R-NJ), a member of the Financial Services banking subcommittee, rejects the idea that lax oversight helped to create the current crisis. “I don’t think deregulation was the cause,” he says in the New York Times article quoted above. “And had we had additional regulation in place, I’m not sure what we’re experiencing now would have been averted.”

Representative Scott Garrett (R-NJ), a member of the Financial Services banking subcommittee, rejects the idea that lax oversight helped to create the current crisis. “I don’t think deregulation was the cause,” he says in the New York Times article quoted above. “And had we had additional regulation in place, I’m not sure what we’re experiencing now would have been averted.”

Some see this current economic adjustment as an inevitable and welcome manifestation of Adam Smith’s “invisible hand,” a force that redirects the many and unaccountable individual questings for profit into a more (some even say, the most) efficient market.

Some see this current economic adjustment as an inevitable and welcome manifestation of Adam Smith’s “invisible hand,” a force that redirects the many and unaccountable individual questings for profit into a more (some even say, the most) efficient market.

Wikipedia utilizes supermarket checkout as an example of this “invisible hand.” I paraphrase: Each customer selfishly chooses to maximize his own interest, that is to check out  in the shortest time regardless of the other customers. Because the utility-maximizing choice is to choose the shortest line, eventually the lines will all be the same length. Therefore without oversight or regulation, and by following only selfish impulses, the most efficient check out process is created.

in the shortest time regardless of the other customers. Because the utility-maximizing choice is to choose the shortest line, eventually the lines will all be the same length. Therefore without oversight or regulation, and by following only selfish impulses, the most efficient check out process is created.

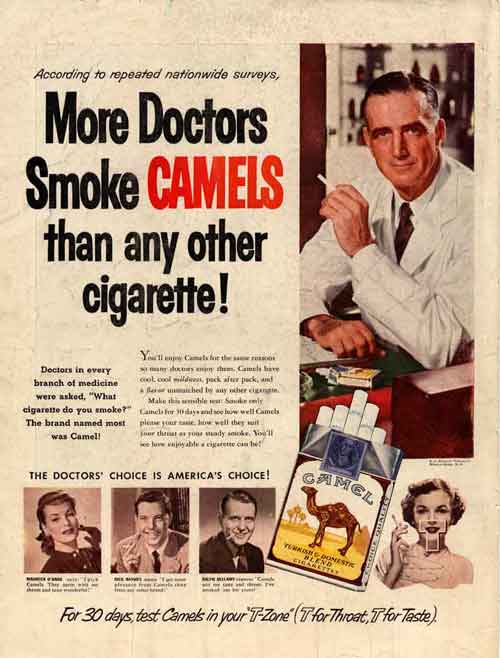

Such creation of efficiency assumes choice (many lines) and full access to information (clear view of line lengths). Some industries, however, achieved massive profits without embodying either of these characteristics. Big Tobacco, for example, offered no choice (“You’re addicted…”) and bad information (“…but we deny it.”)

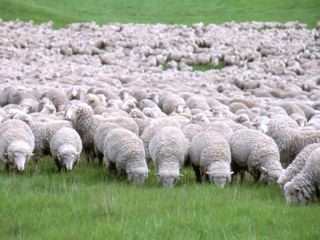

Structural inequities demand oversight and regulation. Consider the social problem described by the late ecologist Garrett Hardin in his 1968 Science essay “The Tragedy of the Commons.” Hardin uses the example of a pasture shared by local herders. Since each naturally wishes to maximize profit, each will increase herd size whenever  possible. Additional animals create a positive effect (increased benefit to the one who adds) and a negative effect (greater degradation of the pasture…shared by all). Since an individual herder gains far more than he loses by adding another animal, all will rationally and continually strive for larger herds, eventually overgrazing the pasture…and the decreasing the combined total utility. As Hardin states, “Freedom in a commons brings ruin to all.”

possible. Additional animals create a positive effect (increased benefit to the one who adds) and a negative effect (greater degradation of the pasture…shared by all). Since an individual herder gains far more than he loses by adding another animal, all will rationally and continually strive for larger herds, eventually overgrazing the pasture…and the decreasing the combined total utility. As Hardin states, “Freedom in a commons brings ruin to all.”

This is not a new concept.

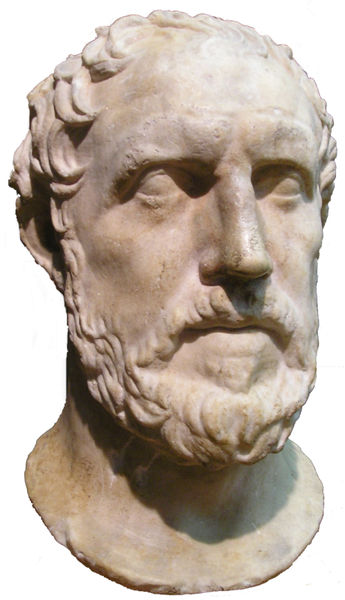

Thucydides wrote: “[T]hey devote a very small fraction of time to the consideration of any public object, most of it to the prosecution of their own objects. Meanwhile each fancies that no harm will come to his neglect, that it is the business of somebody else to look after this or that for him; and so, by the same notion being entertained by all separately, the common cause imperceptibly decays.” —History of the Peloponnesian War,

Thucydides wrote: “[T]hey devote a very small fraction of time to the consideration of any public object, most of it to the prosecution of their own objects. Meanwhile each fancies that no harm will come to his neglect, that it is the business of somebody else to look after this or that for him; and so, by the same notion being entertained by all separately, the common cause imperceptibly decays.” —History of the Peloponnesian War,  Book I, Sec. 141; translated by Richard Crawley.

Book I, Sec. 141; translated by Richard Crawley.

Aristotle expressed a similar thought: “[T]hat which is common to the greatest number has the least care bestowed upon it….everybody is more inclined to neglect the duty which he expects another to fulfill.” —Politics, Book II, Chapter III, 1261b; translated by Benjamin Jowett.

Although conservatives and libertarians may profess otherwise, our financial markets are “commons” that reward most those who would limit choice and full access to information. In the current mess: a) super-large financial institutions control or manage large segments of the mortgage markets; b) mortgage-based and other derivatives are complex to the point of opacity; and c) documents that underly the mortgages (credit reports, income verification, etc.) are often missing or non-existent.

This is not just a Wall Street situation. Similar “commons” problems (climate change, pollution, population, water resource allocation, etc.) demand increased social and economic regulation. One can justifiably kvetch about the predictable inefficiencies of Big Government’s klutzy handling of almost anything it touches, but in our exponentially more complicated technical world, Big Business’s brutal “invisible hand” surely engenders something more dangerous: unpredictably abrupt and structurally unequal misery.

This is not just a Wall Street situation. Similar “commons” problems (climate change, pollution, population, water resource allocation, etc.) demand increased social and economic regulation. One can justifiably kvetch about the predictable inefficiencies of Big Government’s klutzy handling of almost anything it touches, but in our exponentially more complicated technical world, Big Business’s brutal “invisible hand” surely engenders something more dangerous: unpredictably abrupt and structurally unequal misery.

Accordingly, when the tilts of selfishness finally beg for the “invisible hand” to steady the market, the result may be a soft slap, a hard push, or, like the current “credit crunch,” a jaw-jarring knuckle sandwich.

* * * * *

A half-day after writing the above, I checked to see if my post had been picked up by the search engines and found another blogger who linked Hardin’s “Tragedy of the Commons,” to the subprime mess almost a month ago. He also included the Thucydides quote. His analysis of why the mortgage industry disintegrated vertically is spot on. I agree that the dominant strategy was selfish rather than cooperative, but that, in my opinion, is not the “lesson.” Selfishness is inherent in capitalism; it is a driver. I believe the “knuckle sandwich” we are experiencing is the lesson. But will we heed it?

2 Comments on “Subprime Thinking”

Only you could connect the subprime mess to an ancient Greek historian. Nice.

Nope. Not ONLY me. See italicized addendum at the end of the post.

Comments are closed.